real estate

November 14, 2016

Categories

Earlier this summer I stopped by to see a Lake Martin cabin that I had sold a few years ago in the Parker Creek area. This […]

November 8, 2016

Categories

Here at Lake Martin we don’t have a huge mosquito problem. However, they are out there, and a few factors in the last several years made […]

October 31, 2016

Categories

Like a lot of people, I love to check out how Lake Martin home buyers renovate their waterfront homes after the purchase. I was really excited […]

October 24, 2016

Categories

What fire department responds to your house in Lake Martin? The answer is – it depends. Why? Several reasons – Lake Martin is located in […]

October 20, 2016

Categories

Alabama Power’s Shoreline Management staff is hosting a Public Education Open House on Friday, October. 21. The event will be held from 11 to 2 in […]

October 18, 2016

Categories

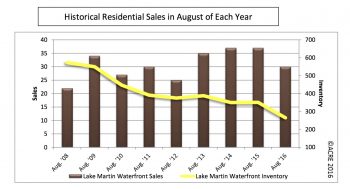

What’s the waterfront real estate market doing right now for Lake Martin? 2015 was a record year for the Lake Martin waterfront market. Was that followed […]

September 28, 2016

Categories

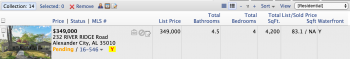

Q: Thank you for all of the email updates for homes for sale around Lake Martin. I see one I like- but it says […]

September 23, 2016

Categories

Do people stay at Lake Martin for Auburn games? I believe the answer is YES. The Lake is a such a short drive to Jordan-Hare Stadium. […]