This Man’s To Blame For Slow Lake Martin Market

Lake Martin Drought of 1941 Was Worse than 2007

July 31, 2007

Lake Martin Real Estate Spotlight: The Ridge Update

August 13, 2007This Man’s To Blame For Slow Lake Martin Market

The Lake Martin real estate market has slowed way down – it’s no longer a sellers’ market. Who is responsible?

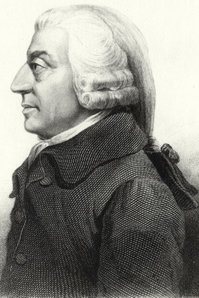

One man – Adam Smith.

One man – Adam Smith.

In 1776 Smith established himself as one of the most influential economic philosophers when he penned Wealth Of Nations. He described the natural economic forces that have existed since the caveman wanted to trade his neighbor one rock for two bones. OK, so maybe he’s not responsible for the slowdown, but he was the man who so eloquently described what is – Supply and Demand.

That’s right – the Lake Martin real estate market has slowed down because of simple supply and demand. Not because of the drought. Not because of the Army Corps of Engineers, not Alabama Power, not Russell Lands. Mr. Smith’s omnipresent Invisible Hand has suppressed the number of waterfront closings. In the 12 months before August 1, 2005, there were 386 waterfront closings. In the 12 months before August 1, 2006, there were 346. In the last 12 months, that number is down to 226. Looking back, the summer of ‘05 was the peak. Face it. There are fewer waterfront closings this summer. But why? In a free market, the more accurate question to ask is always ..

What has affected supply and demand?

SUPPLY:

Easy explanation here. Waterfront property has been on an unprecedented run since 1999. Prices have skyrocketed. Whether we’re talking waterfront property or widgets, more people are willing to sell at higher prices. While supply will always be fixed (Lake Martin ain’t gettin no bigger), the quantity supplied this summer is higher than in 2005. At the peak of the sellers’ market in 2005, there were only 126 waterfront properties for sale. Right now we have 603. Per se, that might not contribute to a slowdown, but when taken in conjunction with…..

DEMAND:

As inseparable as yin and yang, you must consider both supply and demand in any free market evaluation.  So where are all the Lake Martin buyers? Anyone could tell you that they must be scared away by the increase in prices since 1999, but is it a true downward demand shift? Are fewer buyers interested in Lake martin waterfront property now? Or is it simply a decrease in quantity demanded?

So where are all the Lake Martin buyers? Anyone could tell you that they must be scared away by the increase in prices since 1999, but is it a true downward demand shift? Are fewer buyers interested in Lake martin waterfront property now? Or is it simply a decrease in quantity demanded?

Has the drought, low lake levels, and high prices removed buyers from the market? Is that why there is a surplus? I think not. Anecdotally, I am talking to more buyers now than I was in 2005. Buyers that I talk to are not phased by the low lake level. They understand that it is a 50 year anomaly. Sure, I think that the drought has affected it some, by removing potential buyers out of the pipeline before they ever talk to realtors. But I don’t think it has affected demand that much. So I don’t think we’re experiencing a demand shift.

I think the Lake Martin buyers are still out there. There are still plenty of folks who want waterfront real estate, but they want it at lower prices. Case in point: the condo auction at Harbor Pointe. 20 waterfront condos were sold in three hours, when in the previous 12 months, only 34 had sold on all of Lake Martin. Why? Price. The exact same condos that were listed on the mls at $420,000 sold at the auction for about $250,000. This jives with my anecdotal evidence – from talking with buyers. Plenty of people want to own Lake Martin real estate, but not at a crazy price. This extends across all market segments – lots, condos, deeded lot homes, and leased lot homes.

SO WHAT?

So what does this mean? It means that buyers can exert their influence more strongly, by seeking out better values with research. Don’t expect prices to return to the 1990s. But buyers can find decent buys if they know how to research and if they let a good realtor help them. Click here if you need help.

So what does this mean? It means that buyers can exert their influence more strongly, by seeking out better values with research. Don’t expect prices to return to the 1990s. But buyers can find decent buys if they know how to research and if they let a good realtor help them. Click here if you need help.

Lake Martin waterfront sellers need to get realistic. Don’t price things based on what you wish you could get – check the numbers on sold comparables. Hire a good realtor (read: me) that will aggressively market your property – and it will still sell, trust me.

Related Posts:

Proof Of End Of Selllers’ Market On Lake Martin