Why Lake Martin Real Estate Buyers Can’t Time The Bottom

Richard Scrushy’s Lake Martin Home on CNBC – American Greed

January 22, 2009

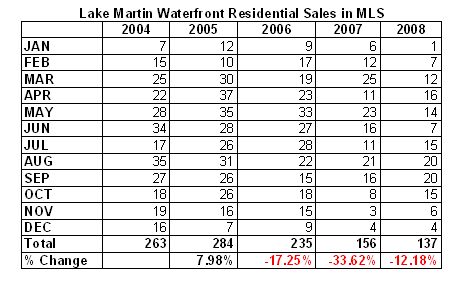

Lake Martin Real Estate Sales – 2008 Year In Review

February 8, 2009Why Lake Martin Real Estate Buyers Can’t Time The Bottom

Contrary to the doom and gloom peddlers, there ARE people out there looking to buy real estate right now, even in a second home, waterfront, luxury market like Lake Martin, Alabama.

Contrary to the doom and gloom peddlers, there ARE people out there looking to buy real estate right now, even in a second home, waterfront, luxury market like Lake Martin, Alabama.

If a buyer is hesitant, a common objection I hear is they say “I don’t think the Lake Martin real estate market is at the bottom yet” or an even more abstract “I think prices are going to come down.” This is usually followed by the inevitable “I’m going to wait and buy at the bottom.”

OK.

Good luck.

Maybe you can do it, but I give you about a 1% chance of success.

Why not? Here are 3 quick reasons why Lake Martin buyers will miss the bottom:

1. If Lake Martin sellers missed “the top” in 2006, what makes you think you can pick the bottom? Lately I have been meeting with a lot of potential sellers. Almost every one of them lamented that they should have sold in 2006. What’s ironic is that many of the sellers whom I met with in 2006 declined to sell, saying that they wanted to wait one more year to get some appreciation. They didn’t see the 2007 drought or the 2008 national real estate meltdown coming. Neither did I. The seller’s market did not last forever, and neither will this buyer’s market. Newsflash – supply and demand always prevails.

2. When / if the market hits the bottom, how will you know? If you ask, what day saw the lowest value (relative to GDP) for one share of IBM stock in the last 20 years, I have a definite answer. But if you ask the same question about Joe Smith’s home on 123 Lake street, it’s impossible to know. Each share of IBM stock is the same. But not every Lake Martin home is the same. One might smell like cat pee. The other might be near where you learned to ski. Both of these things tangibly contribute to the calculation of value to a buyer and seller. Try to graph that one.

3. Timing “the market” is almost impossible in ANY market – because we are all humans and therefore imperfect. Picking a perfect bottom or top is almost impossible in any market, be it for ligers or lake homes. I am not talking about saying “I knew that lake homes prices were getting too high” – I am talking about telling me the EXACT day and the EXACT price at which to sell. Don’t tell me “I knew Google would be a winner” – show me your receipts from the IPO when everyone was laughing at the geeks and suckers paying $85 / share.

3. Timing “the market” is almost impossible in ANY market – because we are all humans and therefore imperfect. Picking a perfect bottom or top is almost impossible in any market, be it for ligers or lake homes. I am not talking about saying “I knew that lake homes prices were getting too high” – I am talking about telling me the EXACT day and the EXACT price at which to sell. Don’t tell me “I knew Google would be a winner” – show me your receipts from the IPO when everyone was laughing at the geeks and suckers paying $85 / share.

Here are some quotes from a few of the many people who are smarter and more experienced than I am:

“Ignore market timers, Wall Street strategists, technical analysts, and bozo journalists who make market predictions…Admit to your therapist that you can’t beat the market. Investors would also benefit by remembering this simple phrase: trading is hazardous to your wealth.”

– Jonathan Clements, Columnist, Wall Street Journal

“I am fearful when others are greedy, and greedy when others are fearful.”

– Warren Buffet, A Guy Who Is Way Richer Than You

“After nearly fifty years in this business, I do not know of anybody who has done it [market timing] successfully, and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently. Legendary investor Bernard Baruch said it best: “Only liars manage to always be out during bad times and in during good times.”

– John C. Bogle, Sr., Former Chairman & Founder, The Vanguard Group

SO WHAT?

Am I recommending throwing out all logic and making real estate decisions with the heart?

Of course not.

I am merely saying that if you wait until every talking head in America says it’s OK to buy real estate again, it will be too late. At that point, we will be on the verge of another bubble bursting. If now is not a good time for you to buy on Lake Martin, OK. No problem. Just don’t let Matt Lauer be the one to make your decision for you.

I am merely saying that if you wait until every talking head in America says it’s OK to buy real estate again, it will be too late. At that point, we will be on the verge of another bubble bursting. If now is not a good time for you to buy on Lake Martin, OK. No problem. Just don’t let Matt Lauer be the one to make your decision for you.

Agree? Disagree? Leave a reply and let me hear about it. Click on the Comments link and let’s talk.