report

February 9, 2022

Sales! Inventory! Pricing! Forecast! All of this and more in my latest Lake Martin Real Estate Market Report. Please take a few minutes and watch my […]

November 30, 2021

Is the real estate market at Lake Martin at its peak? Are we still in a hot seller’s market? Please take a few minutes and watch […]

June 28, 2021

Categories

Waterfront home sales were the best ever in 2020 at Lake Martin, Alabama. What did sales look like in April 2021? For the month of April […]

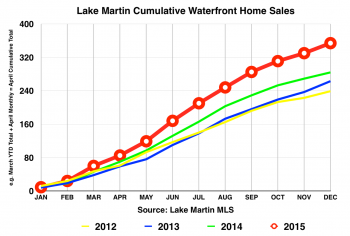

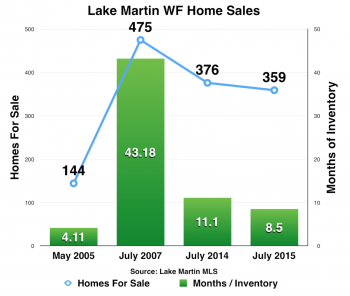

February 2, 2016

Lake Martin had its best year ever for waterfront real estate sales in 2015. Sales were better in 2015 than in the big real estate days […]

October 14, 2015

Categories

Lake Martin, Alabama has awesome striped bass fishing in the fall. Here at Lake Martin we are proud to be one of the best freshwater fisheries […]

August 24, 2015

Categories

June waterfront home sales on Lake Martin were up 44% from last year! Yes, you read that right. The Lake Martin real estate market is doing […]

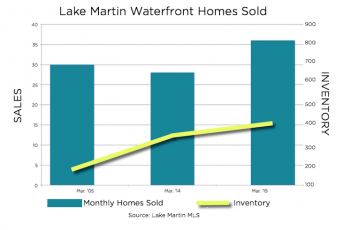

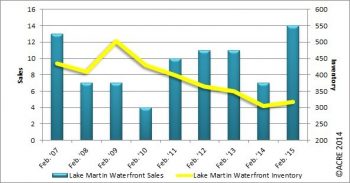

May 18, 2015

March 2015 was another great month for Lake Martin waterfront home sales. The graph below was provided by the Alabama Center for Real Estate (ACRE). On […]

April 17, 2015

Often, I’m asked, “How is the market doing in 2015 compared to 2014?” In short, I think its doing great! If you look at the graph […]