Lake Martin 2009 Waterfront Sales Match 2008 In First Quarter

Keep Lake Martin Green At the Tallapoosa River Basin Watershed Conference

April 22, 2009Lake Martin BBQ Fans – Check Out The Red Hill Cottage Cafe

May 5, 2009Lake Martin 2009 Waterfront Sales Match 2008 In First Quarter

“Have Lake Martin sales picked up yet?”

I get this questions a lot. Waterfront sales on Lake Martin are cyclical anyway, and after a tough Oct – Dec 2008 everyone is anxious to see if 2009 will be the year the market takes back off.

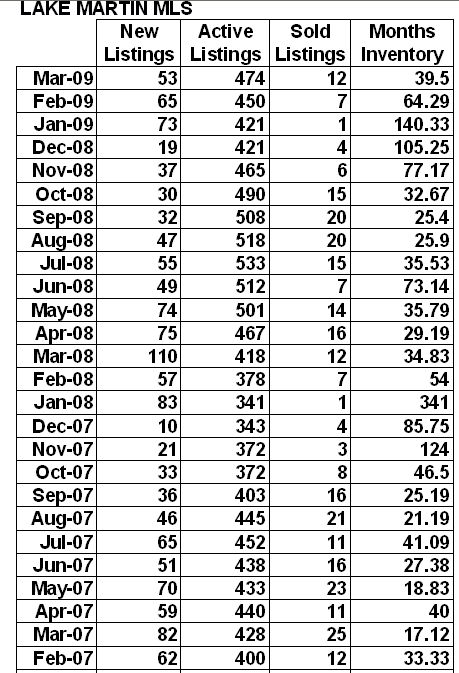

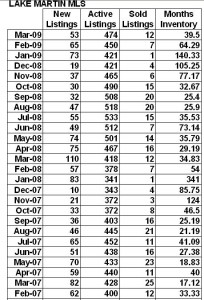

So far, it looks like January – March 2009 (1Q09) is in lockstep with waterfront sales in 1Q08. There were 20 sold in 1Q08 and 22 sold in 1Q09:

I guess I could make a sensational headline like:

“2009 Sales Are Up 10% Over 2008” but when that 10% = 2 sales, well, it seems like (statistically) a close call.

I think the real story lies in the active listings and new listings columns. In March 2008 we added 110 listings for sale around Lake Martin, and had a total of 418. In 2009, there was a little more total for sale, at 474, but in March 09 only added 53 to that total.

So what?

To me that is a sign of hope that sellers are pulling back a bit, and only selling when they are serious. I also think it is obvious that there is a lack of new spec homes on the market. Waterfront spec homes were still hitting the Lake Martin real estate market back in 08 because the pipeline can sometimes be about 8 months. In other words, new spec homes popping up as new listings in January 2008 were likely started around April 2007. But by April 2008, everyone had figured out that we were in an extreme buyers market, and quit starting spec homes.

The only spec homes now on the market are holdovers from 2007 and 2008, and in some rare cases, 2006.

Foreclosures? Short sales?

Yes, Lake Martin is starting to see more foreclosures and short sales.

It’s hard to come up with an easy list of Lake Martin foreclosures or short sales because there is no field in the Lake Martin MLS to designate as foreclosure or short sale. In contrast, you can easily search for waterfront homes or lots by choosing “Y” in a Lake Martin MLS search here. For foreclosures and short sales, you pretty much have to deduce it by the seller (a bank or some other financial sounding company) and also the trusty Lake Martin grapevine.

What will the Lake Martin real estate market do in 2009?

No one can know for sure at this point, of course, but here are a couple of indicators that I watch:

1.) 2009 monthly sales beating 2008 – by this I mean in number of homes sold. We have already seen in 2008 that average prices fell. So according to what we know about real estate cycles then we should expect to see individual months in 2009 beating their 2008 counterpart BEFORE we see prices rebound. But, current year MUST start beating prior years. It happened in the last part of 2008, and 1Q09 beat 2008 timidly, which is why the smart money eyes will be on the crucial period of 2Q09 (April – June 2009).

2.) Cities / States that were Bubble Sources – I am not a real big believer in strong trickle down connections between markets, at least in a 1 to 1 relationship. But it is interesting to watch with the economy as a whole. I watch Florida, California, and Atlanta.

Related Posts:

Lake Martin Market Statistics Category

(*)Disclaimers: All of the above info was taken from the Lake Martin Area Association of Realtors Multiple Listing Service. Accuracy is not guaranteed but deemed reliable. The above does not include sales by FSBOs or developers that sell privately and not through the MLS. But, I do think that the above represents a very large majority of all sales on Lake Martin.