Lake Martin June 2025 Market Report

Taylor Hicks at The Landing at Parker Creek

August 29, 2025

Best Boat for Lake Martin

September 6, 2025Lake Martin June 2025 Market Report

Lake Martin June 2025 Market Report

It’s halftime here at Lake Martin. The first six months are over, so I thought I’d give us a mid-year update for the June 2025 market report at Lake Martin real estate wise. In this blog, I’m going to cover what the average home sales were, what the average price is, and cover lot sales.

Homes Sold in 2025 on Lake Martin

We always like to look at raw numbers of home sales. So, what happened compared to last year? So far, from the beginning of this year to June, we’ve had about 136 waterfront homes sold. That’s the entire lake, all agents, and all brokerages.

The number of homes sold is up about 2% from last year, because last year was 133 homes the first half of the year. I was kinda surprised by that, but we are still 10% below our 5-year average.

However, this is not really a half of our sales because the bulk of our sales happen from March to October on Lake Martin. Really the hot months of May, June, July, August, and September are the bulk of our sales. So, we are trending slightly ahead of last year but still 10% lower than our 5-year average.

Average Prices of Homes in 2025 on Lake Martin

So, what are some pricing trends that I see so far through June 30th of this year? Well, we’ve got $195 million worth of waterfront home sales on Lake Martin through the end of June.

Now, if I average that out on those sales that comes to about $1.4 million as our average sales price for this year so far. I was kind of surprised by this, because last year the average was about $1.21 million the entire year. So, we’re trending about 10% higher than our average sales price for 2025.

One thing that I track is the number of homes that have sold that had to have a price drop and the numbers of homes sold that sold above list. Last year, 32% of all homes that sold had a price drop. This year, in 2025 is 36%. So, that’s actually about a 10% increase in the numbers of homes sold that had to drop their price, which is a buyer’s market indicator. That’s good for buyers.

What about over list? In 2024, about 8.3% of homes sold above list price. This year It’s 3.6%. That’s actually lower than our prior year average of homes selling over list about 50%. That’s a pretty big drop, and so I think that’s another buyer market indicator pricing wise.

What I’m seeing is that pricing is in a little bit of a wacky area right now, especially in this average price range from about $1.1 million to about $1.5 million. Sometimes it can be hard to price homes because you get surprised on some things. This is sort of a Jackal and Hide slide I think to me. On one hand, you see increased average price and on the other you see these.

Pricing for Homes: Lake Martin June 2025 Market Report

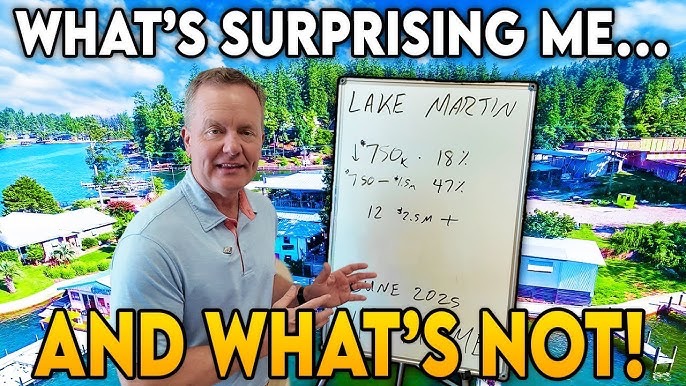

I took a look and counted residential sales on the waterfront through the end of June. About 18% sold for below $750K. Now, this stat includes condos. I did not pull out condos for this stat. However, my history tells me that if you pull out condos from that and just look at single family homes, that number would be way lower.

Right now, I’ve got a condo under contract in Harbor Pointe that would fit in this category. I’m also about to list a home that would fit into that category, but it’s pretty few and far between.

If you just look at residential sales in general from $750,000 to a $1.5 million, it’s 47% of the market. So, that is the big huge hunk of the big middle part of the bell curve. That means there’s a 47% chance if you buy a residence on Lake Martin, it’s going to be between $750K and $1.5 million.

We’ve had 12 homes that sold for over $2.5 million, and we had a closing that was a little bit over $8 million inside The Willows neighborhood. I think that might be pretty close to a record in MLS at least of a home anywhere on the lake over $8 million.

Days on the Market

All right, so what about inventory? What about homes for sale? So far this year, in 2025, our days on market averaged about 92 days. In 2024, that was 88 days on the market. So, we slightly increased about 3%. I get that question from sellers all the time about how many days will the house be on the market before it closes, and 90 days is the answer for right now.

For our particular market, it can be a little bit tricky. This is because, like I’ve said before, we’re a seasonal market. So, sometimes it depends on when you’re putting your house, lot, or condo up for sale. If you put it on right at Thanksgiving, those first three months could be pretty slow. That could add 90 days on the market.

I don’t really think buyers, in our market at least, really harp on days on market. If something’s been through the winter, I really don’t think it matters.

Inventory: Lake Martin June 2025 Market Report

What are the inventory numbers? I was a little surprised because May and June averaged about 10% lower than the same month in 2024.

We’re still 25% above our 5-year average. So, if you just looked at May and June, you would think inventory is trending down year to year. But, if you step back and look at the 5-year average, then we can see that we’re 25% above our 5-year average.

When people say there’s nothing to buy on Lake Martin, that’s not accurate. Our total inventory numbers are higher. However, if you start looking in really tight segments such as a house on the west side of the lake for under a million dollars, then you’re going to probably come down about 4 or 5 sales per year out of 260. When you slice it down real thin, that’s why sometimes it feels like there’s not many things to sell.

Lots: Lake Martin June 2025 Market Report

What about waterfront lots? Our sales are actually down a little bit. In June of 2024, we sold 29 lots through the MLS. This year, it’s only 26. So, that’s a decrease of about 10% of numbers of lot sales.

This June we sold zero. There were no waterfront lot sales registered for June. The last time that happened was June of 2012. So, for the first time in 13 years, we’ve had a month where no lot sales were recorded.

The low price on lot sales was $95,000 on a lot in Manoi Creek on the east side of the lake. The highest was about $2.32 million in The Heritage. It’s a really popular new Russell Lands neighborhood that has been selling a lot of lots recently.

So, how does a 10% decrease in the sales affect lots? Well, I think it’s more than made up with the lack of inventory for lots. Now, I’m going to agree with you if you say there’s nothing to buy on Lake Martin when talking about lots.

This time last year, we we were averaging about 70 lots for sale. This year, almost every single month, we’re hovering around the 40s, like 43 or 47 lots for sale. That’s kinda why it feels that the the market for lots is pretty tough.

Lots Deep Dive: Lake Martin June 2025 Market Report

To delve a little deeper on the lot side because even though there’s only like 26 or so sales, I wanted to kind of dig a little deeper so we could see what’s happening there.

Price wise lots are selling for about $500K. That’s going to be my answer if you ask. This is because we had three sales that were $0 to $200K, eight sales from $200K to $500K, and nine sales from $500K to a million. That’s where most of these sales are happening.

That’s why I’m saying if somebody asked me what they should expect to pay, I’m going to probably tell you $400K to $600K. That is going to be the bulk of where these waterfront lot sales are happening. But again, when only 26 are selling through the whole first 6 months of the year, then there aren’t a lot of lots.

Also, 10 of these 26 are home sales where it’s in neighborhoods with no architectural restrictions. Prior years have been dominated by neighborhoods such as The Heritage that have a pretty heavy architectural review control. I think maybe five of these sales were by Alabama Power. But, a high number of these sales so far this year are in non-ARC neighborhoods.

Only 15% of the lots that sold had price drops. So, that to me is a pretty strong indicator of a strength. This year, it feels like we’re in a seller’s market for lots for sure.

Worst Metric is Per Square Foot

One of the worst metrics that I think you can use on Lake Martin is price per square foot. It will trip you up every time, and it is a strong siren. I’m a math guy. I would love to have some great price per square foot theory, but it just doesn’t hold up.

We had a sale for $4.447 million in a 5400 square foot house that came out at $813 a square foot. We also had a condo for $350,000 sale at 866 square foot which was $390 per square foot.

So, if you say what is the highest and the lowest? Well, it ranges. Lake Martin ranges from $400 a foot to $813 a square foot. My point is that’s such a wide range. That just goes to show you, don’t start at per square foot.

You need to start with what I’ve said a million times which is view first, privacy second, location third, and then the bricks and sticks are fourth. That’s how you price Lake Martin property.

Top Neighborhoods For Waterfront Lake Home Sales 2025

The Ridge is one of Russell Land’s larger developments. It has a marina inside there and a lot of different amenities. So, The Ridge is the top neighborhood. Also, Trillium is another example and is on the Kowaliga side of the lake. It’s a really flat, woodsy neighborhood.

Another top neighborhood was StillWaters. It’s over on the east side of Lake Martin in Dadeville in the Blue Creek area. Therefore, it’s close to Auburn and all those sort of things. It too is a gated neighborhood and has a lot of amenities inside of it. It’s got Harbor Pointe Marina and The Landing at Harbor Pointe.

Cash Sales: Lake Martin June 2025 Market Report

I also get asked the question of what are the cash sales or is cash really heavy at Lake Martin? Generally, yeah. I mean, because we’re a second home market, 80% of our waterfront homes are second homers for people.

This year, about 41% of sales have been cash. Compare that nationally to 28%. You think, well, that’s only 13% difference. Well, 13 over 28, that’s almost 50% greater than the national average. Maybe 20% more sales are almost cash.

Architects at Lake Martin Alabama

Also, another thing that I’m seeing is an increase in homes sold that were designed by architects. That’s a big difference. We see a lot of different types of lake houses on the lake. Some are old cabins that are fixed up, some new houses were maybe built in the last 10 years, but from a plan that somebody kind of picked from a magazine somewhere or something like that.

When I say an architect designed home, I mean a home that was designed by an architect for that lot for that client. So, that’s where architect comes and looks at the lot, the sun, and they talk to the client.

There’s a definite premium for homes that I see that are custom designed by architects for each lot. For example, one of the ones I closed this year was done by Bobby McAlpine. Certainly one of the most famous architects around here and certainly nationally.

With an architect designed house it takes advantage of the views, the natural topography, and you can just tell. I’m noticing a premium of homes that are designed like that and selling on the lake. I think that may be affecting our high home sales numbers this year.

Contact Information

If you are looking to buy or sell a home on Lake Martin, then please give me a call at the number on the top of this page. You can also reach me through my email or Contact Page.

I’m John Coley, and I love to help people out. If you think we would be a good fit, then contact me! I look forward to hearing from you.

For more blogs like this June 2025 market report for Lake Martin or to check out my new listing, visit the links listed below:

Election Effects and 2024 Market Report | Lake Martin Alabama

A Seasonal Market on Lake Martin