Seller Tips

March 28, 2017

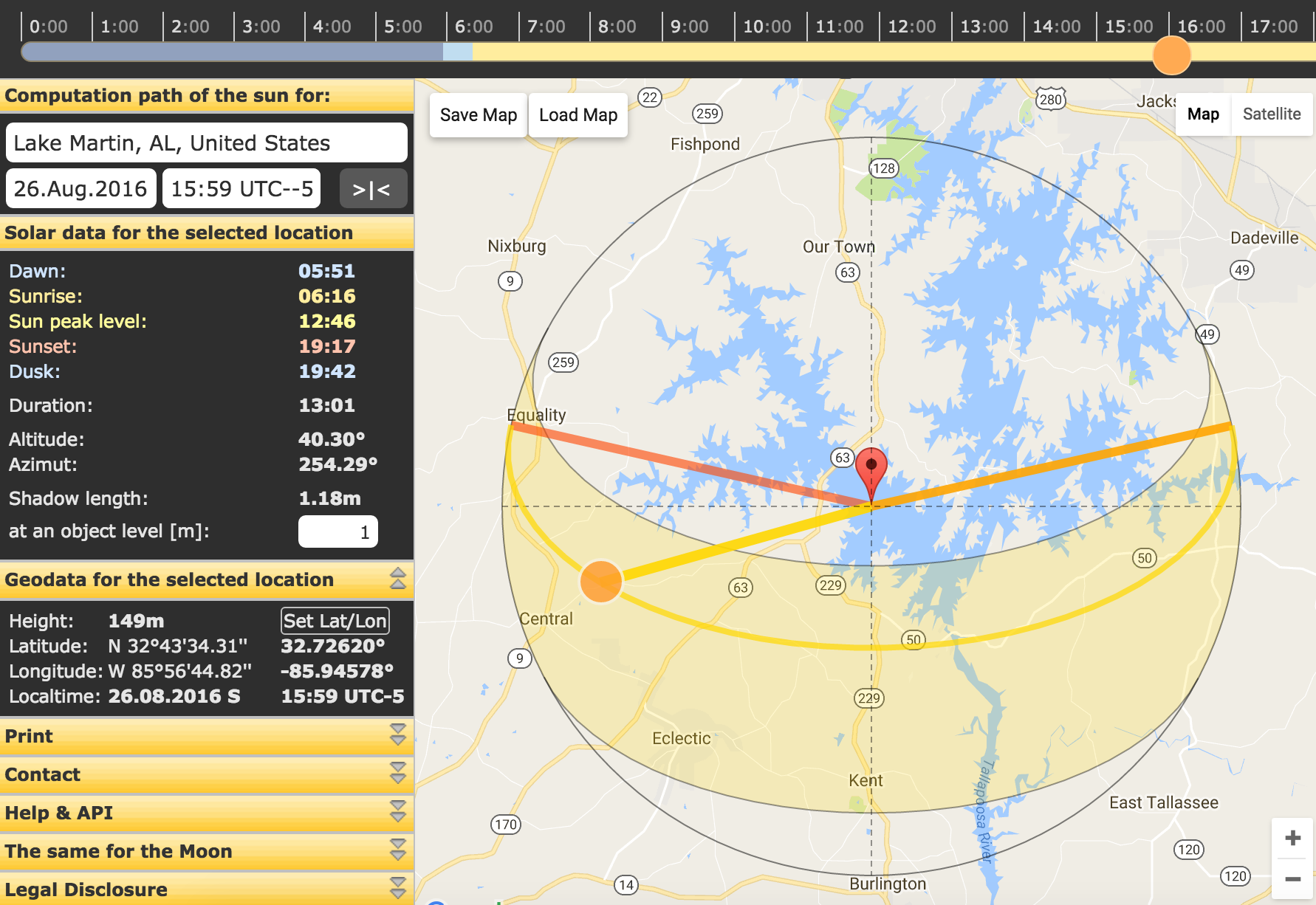

Anytime is a great time for taking pictures around Lake Martin. I can think of so many great occasions – times when you want to say […]

January 25, 2017

Zillow doesn’t work here at Lake Martin for selling waterfront real estate. It is terribly inaccurate. I get reminded of this every now and then when […]

December 20, 2016

The State of Alabama requires a certain amount of education before one can sit for the real estate licensing test. One huge part of the licensing […]

September 2, 2016

Categories

Check out this cool, outdoor living area in my newest listing – a waterfront home for sale at 570 Wake Robin, Eclectic – Lake Martin! Built […]

August 10, 2016

Note: I originally published this article in my monthly column in Lake Magazine. I am proud to write about Lake Martin Real Estate for Lake Magazine. […]

July 12, 2016

Note: I originally published this article in my monthly column in Lake Magazine. I also published it on my column on al.com – where I am […]

May 18, 2016

Categories

The “Next Big Thing” in real estate technology is 3D Tours By Matterport. It is a new, breakthrough tool that I think will become indispensable in […]

May 13, 2016

There are not many waterfront foreclosures right now in the Lake Martin market. I haven’t run the numbers yet, but my feeling is that they peaked […]