lot

December 15, 2023

The Lake Martin Alabama waterfront real estate market showed two interesting trends when we review the October 2023 sales results. I break down the numbers and […]

February 9, 2023

Congratulations to architect Bobby McAlpine for being named one of the top 500 business leaders for 2023 in the latest issue of Atlanta Magazine! I’m not […]

March 1, 2022

It’s always an honor to be chosen to help buyers find waterfront property here at Lake Martin. But it’s especially gratifying when the buyers are friends […]

January 10, 2022

Price Drop on lot in the Willow Glynn neighborhood at Lake Martin! 1277 Willow Glynn Way is a large, private, interior lot with easy access to […]

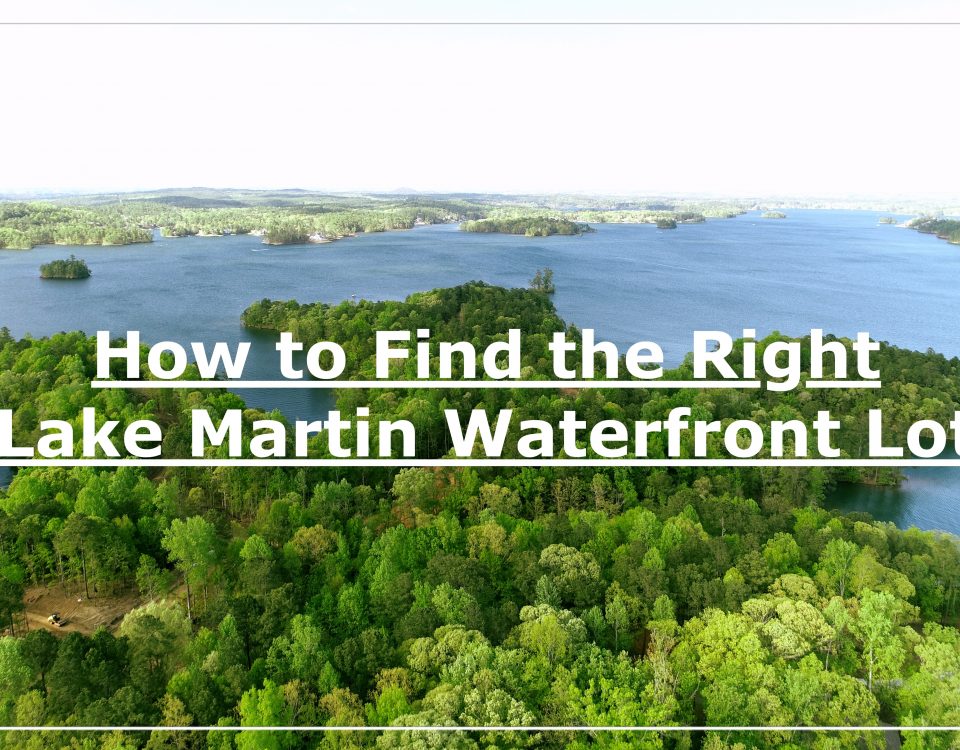

March 23, 2020

As a full time real estate agent here on Lake Martin, Alabama, I get asked all the time about what is the best way to go […]

March 11, 2020

Please take a look at my above video. I am John Coley. I am a real estate agent with Lake Martin Voice Realty and this […]

December 13, 2018

As the Listing Broker for Kennebec at Lake Martin I get asked a lot of questions. One that I get asked a lot is “How […]

September 5, 2018

Categories

How would you like a lot in The Ridge at Lake Martin for under $150k? Lot 88 Ridge Crest in The Ridge has huge southeasterly views […]